Jeremy Grantham has made a bold call regarding the American stock market, speaking on the possibility of the S&P 500 losing 50% of its value.

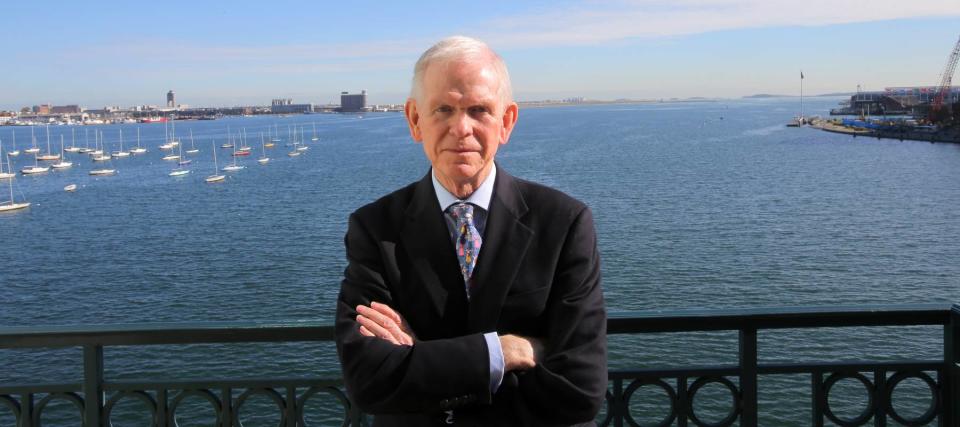

The renowned British investor and co-founder and chief investment strategist at Boston-based GMO LLC recently joined Merryn Somerset Webb on Bloomberg’s ‘Merryn Talks Money’ podcast, where he shared his deeply doom-and-gloom take on the state of the U.S. stock market.

Don't miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Rising prices are throwing off Americans' retirement plans — here's how to get your savings back on track

'A natural way to diversify': Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — 3 ways you can prepare

“Don’t invest in the U.S.,” he said, pointing to the nation’s $33 trillion debt crisis, elevated interest rate environment, unsustainably high yield levels and the immense challenges in the real estate and mortgage markets.

Instead, he pointed to developed markets like the United Kingdom, Japan and most of Europe as being good and “cheaper” alternatives to investing in the U.S.

“In general, the rest of the world seems investable,” he said. “Do your analysis, make your mistakes et cetera, but it's reasonable.”

Here’s why Grantham is so concerned about the state of the U.S. stock market and how you can adapt your investing strategy if you share his bearish views.

The state of the US market

Grantham has a classically bearish outlook on the U.S. market. As Somerset Webb pointed out, the investment strategist is known for his analysis of bubbles and for his bearish forecasts that have come at useful times, such as 2000 when the dot com bubble burst and 2007-2008 with the subprime mortgage crisis.

According to Grantham, the “most vulnerable area” in the U.S. market at the moment is the Russell 2000 Index, a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell 3000 index. This is often considered a bellwether of the U.S. economy because of its focus on small companies that make up the bulk of domestic business.

“It has a very high density of zombies — companies that really can only pay their interest payments by issuing more debt,” he said of the Russell 2000. “A very high ratio — something like 40% — don’t have positive earnings and they have record debt.”

Grantham had little better to say about the S&P 500. He's forecasting a dip to below 3,000 points, which would be “reasonable” in his mind. The index is currently hovering around 4,500 points.

“If everything works out badly, which it sometimes does, I would not be amazed if it went to 2,000,” he said. “But that would require a couple of wheels to fall off.”

Really, it's the “Magnificent Seven” — the seven largest U.S. companies by market capitalization: Apple, Microsoft, Amazon, Google, Nvidia, Tesla and Meta — that are carrying the U.S. market and asserting its global dominance, according to Grantham.

He said the Magnificent Seven’s “unprecedented” earnings and stock market performances this year — with the help of “a steady rise in PE [private equity]” — lead to “the sudden emergence of multitrillion-dollar market caps.”

But if you took them out of the equation, “the S&P 500 would not be up for the year,” Grantham said.

“There has never been such a narrow market,” he told Somerset Webb. “What will happen to them is a very interesting question. Will they continue to grow and become 70% of the entire world's market cap? Will they be attacked by governments? Will they attack each other, grow into each other's markets and beat down their profit margins? … Who knows.”

Amid such uncertainty, there are various ways you can mitigate risk in your investment portfolio.

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

If you must invest in the US — do this

If you remain confident in the U.S. stock market conditions and want to continue investing in domestic companies, Grantham said it’s critically important to “take a good look at quality.” There's a good chance that a company's true value may not be reflected in its price.

“Quality has been the miss-priced asset for 100 years,” he said.

He gave the example of AAA bonds, which are deemed to have the highest creditworthiness and the lowest degree of investment risk. “They outperform in bear markets and they underperform in bull markets … because they’re boring,” he said.

“In a bull market, you want Tesla, you want to own meme stocks, you want to own what's fly,” Grantham continued. “You don't want to own Coca-Cola. It's just too boring. In the long run, Coca-Cola does very well.”

He added: “When it comes to quality, they have less risk every time. They have less debt, they go bankrupt less, they have less volatility, they have a lower beta, yet they out-perform.”

A quality investment, according to Grantham, would be a company with low debt and high, stable returns. And he’s not the only high-profile investor to preach such advice.

Warren Buffett is a huge advocate for value investing and backing high-quality businesses with low capital needs — his favorite seemingly being Apple, which makes up over 45% of Berkshire Hathaway’s investment portfolio as of Sept. 30, 2023, with holdings worth over $165 billion.

If you’re bearish about the US — look elsewhere

It’s relatively easy to invest in global stocks these days — and doing so has three big advantages: diversification, an expanded universe of opportunities and global growth potential.

There are a few different ways to access foreign stocks, including buying them directly in a “global account” offered by brokers such as Fidelity, E-TRADE or Interactive Brokers. But that method isn’t ideal for average investors. Direct foreign investing comes with added costs, tax implications, currency converting and a whole host of support issues.

If that sounds too complex for you, consider investing in exchange-traded funds (ETFs) that will give you exposure to international markets. ETFs will typically let you target the exact geographies you want and will cover a wide variety of investment categories.

A good example is the Vanguard FTSE Developed Markets ETF, which gives you access to 3,700 companies in developed overseas markets like Western Europe, Japan and Australia. Meanwhile, the iShares MSCI Emerging Markets Small-Cap ETF provides exposure to small public companies in emerging markets, including Taiwan, India and Brazil.

Another option is to buy American Depository Receipts (ADRs), which are certificates issued by a depository bank that represent shares in a foreign corporation but are listed on a domestic U.S. exchange.

ADRs were created specifically to sidestep the currency, tax and cost issues of buying foreign stocks directly. They are listed, bought, sold and settled just like stocks of U.S.-based companies, making them a breeze to invest in.

It’s important to remember that foreign investing also comes with some unique risks, including currency fluctuations, political turmoil and unfamiliar business practices. Newer investors might try a low-stakes approach of using an investment app to get started.

With files from Brian Pacampara

What to read next

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2023

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.