Is unearned revenue a credit?

Also known as deferred revenue, unearned revenue is recognized as a liability on a balance sheet and must be earned by successfully delivering a product or service to the customer. On a balance sheet, unearned revenue is recorded as a debit to the cash account and a credit to the unearned revenue account.

Unearned revenue is an account in financial accounting. It's considered a liability, or an amount a business owes. It's categorized as a current liability on a business's balance sheet, a common financial statement in accounting.

After the goods or services have been provided, the unearned revenue account is reduced with a debit. At the same time, the revenue account increases with a credit. The credit and debit will be the same amount, following standard double-entry bookkeeping practices.

Unearned revenue should be entered into your journal as a credit to the unearned revenue account, and a debit to the cash account. This journal entry illustrates that the business has received cash for a service, but it has been earned on credit, a prepayment for future goods or services rendered.

The normal balance of unearned revenues is a credit. QN=86 A credit is used to record: a. A decrease in an expense account.

Typically, when reviewing the financial statements of a business, Assets are Debits and Liabilities and Equity are Credits.

Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead found on the balance sheet as a liability. Over time, the revenue is recognized once the product/service is delivered (and the deferred revenue liability account declines as the revenue is recognized).

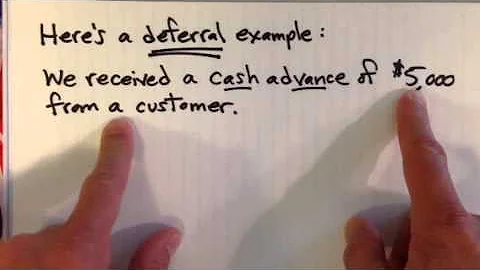

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. Accrued expenses refer to expenses that are recognized on the books before they have actually been paid.

What type of account is the unearned revenue account? Unearned revenue is a liabilities account. Unearned revenue represents cash a company received prior to performing any work of giving a customer a product. Until the company performs work the company owes the customer money or the service/product.

Where is unearned income reported on your tax form? You'll report unearned income on the IRS Form 1040. You may have to include Schedule 1 with your return.

Is unearned revenue accounts receivable?

Unearned revenue is not accounts receivable. Accounts receivable are considered assets to the company because they represent money owed and to be collected from clients. Unearned revenue is a liability because it represents work yet to be performed or products yet to be provided to the client.

Unearned Revenues. Refers to cash received in advance of providing products and services. Unearned revenues are liabilities. As products or services are provided, the unearned revenues become earned revenues.

| DEBIT (DR) | CREDIT (CR) | |

|---|---|---|

| Increases | Decreases | Decreases |

| Asset account Expense account Loss account | Liability account Equity account Revenue account Gain account | Asset account Expense account Loss account |

In bookkeeping, revenues are credits because revenues cause owner's equity or stockholders' equity to increase. Recall that the accounting equation, Assets = Liabilities + Owner's Equity, must always be in balance.

A debit to a liability account means the business doesn't owe so much (i.e. reduces the liability), and a credit to a liability account means the business owes more (i.e. increases the liability). Liability accounts are divided into 'current liabilities' and 'long-term liabilities'.

Key Takeaways

Working capital is the difference between a company's current assets and its current liabilities, which it records on its balance sheet. Unearned revenue decreases a company's working capital because it is considered a liability.

Interest. Interest and dividend income are the most common types of unearned income. Money received this way is unearned income, and the tax paid on it is considered an unearned income tax. Interest income is normally taxed as ordinary income on sources that earn income, including: Checking and savings deposit accounts.

Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a customer for products or services that will be delivered at some point in the future.

Unearned revenue is recorded on a company's balance sheet as a liability. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer.

Example of Unearned Revenue

For Amazon, Fred's payment ($79) is unearned revenue since the company receives the full payment in advance while none of the services have been provided to Fred yet. Initially, the full amount will be recognized as unearned revenue on Amazon's balance sheet.

When unearned revenue is debited what is credited?

Debit the cash/bank account with the total amount received, i.e., $6,000, and create a current liability of unearned revenue by crediting the same amount. The revenue is yet to be earned by the business, and hence the same is credited as a liability.

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. The company that receives the prepayment records the amount as deferred revenue, a liability, on its balance sheet.

What types of accounts are debited and credited in an unearned revenue adjusting entry? In an unearned revenue adjusting entry, liabilities are debited and revenues are credited.

Unearned revenue is a liability account that reports amounts received in advance of providing goods or services. When the goods or services are provided, this account balance is decreased and a revenue account is increased.

Accrued revenue represents revenue that you have earned and for which you are yet to receive payment. Unearned revenue, also referred to as deferred revenue, refers to payments you have received for services you are yet to render.

Unearned revenue occurs when a company sells a good or service in advance of the customer receiving it. Customers often receive discounts for paying in advance for goods or services.

On a balance sheet, accounts receivable is always recorded as an asset, hence a debit, because it's money due to you soon that you'll own and benefit from when it arrives.

In bookkeeping, revenues are credits because revenues cause owner's equity or stockholders' equity to increase. Recall that the accounting equation, Assets = Liabilities + Owner's Equity, must always be in balance.

Is deferred revenue a credit or a debit? Recording deferred revenue means creating a debit to your assets and credit to your liabilities. As deferred revenue is recognized, it debits the deferred revenue account and credits your income statement.

A Revenue Credit Account (RCA) is an unallocated suspense account within your plan that holds the excess revenue that may be generated by your plan.

Is a revenue credit a positive or negative?

How are they used? The revenues are reported with their natural sign as a negative, which indicates a credit. Expenses are reported with their natural sign as unsigned (positive), which indicates a debit.

Revenue. In a revenue account, an increase in debits will decrease the balance. This is because when revenue is earned, it is recorded as a debit in the bank account (or accounts receivable) and as a credit to the revenue account.

Journal Entry of Deferred Revenue. The following Deferred Revenue Journal Entry outlines the most common journal entries in Accounting. In simple terms,, Deferred Revenue. The examples include subscription services & advance premium received by the Insurance Companies for prepaid Insurance policies etc.

What is the difference between deferred revenue and unearned revenue? There is no difference between unearned revenue and deferred revenue because they both refer to advance payments a business receives for its products or services it's yet to deliver or perform.

A deferred tax asset is a business tax credit for future taxes, and a deferred tax liability means the business has a tax debt that will need to be paid in the future.

You didn't go into business to become an accountant, so it's understandable that you'd have questions like: “are expenses debit or credit?” In short, because expenses cause stockholder equity to decrease, they are an accounting debit.

Revenue increases income I.e. income credited means revenue increased, so it indicates credit. Other hand, expense decreases income which is just opposite of credit in terms of income earned.So, expenses are debited.

Recording Accrued Revenue

When one company records accrued revenues, the other company will record the transaction as an accrued expense, which is a liability on the balance sheet. When accrued revenue is first recorded, the amount is recognized on the income statement through a credit to revenue.

Unearned revenue is cash received by a business for goods or services yet to be provided. It is recorded as a liability on the business's balance sheet until the contract is completed. Unearned revenue can be accrued in a variety of different ways. For example, a one-year gym membership.