What is the $2800 tax credit?

Married taxpayers who file a joint return that claims two qualifying dependents and an AGI of $155,000 will have a maximum credit $2,800 (again, half the full amount).

You were issued the full amount of the Recovery Rebate Credit if your third Economic Impact Payment was $1,400 ($2,800 if married filing jointly for 2021) plus $1,400 for each qualifying dependent reported on your 2021 tax return.

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

The maximum credit amount has increased to $3,000 per qualifying child between ages 6 and 17 and $3,600 per qualifying child under age 6. If you're eligible, you could receive part of the credit in 2021 through advance payments of up to: $250 per month for each qualifying child age 6 to 17 at the end of 2021.

If your refund is short $2,800 then that is because you said you did not receive the 3rd stimulus payment and the IRS has records that show you were sent the 3rd stimulus payment so they removed the $2,800 Recovery Rebate Credit that was entered on Form 1040 Line 30.

Biden's plan calls for raising the current maximum child credit from $2,000 per child to $3,600 per child under age 6 or to $3,000 per child ages 6 and up.

The American Rescue Plan Act of 2021 (American Rescue Plan), enacted in early March 2021, provided Economic Impact Payments of up to $1,400 for eligible individuals or $2,800 for married couples filing jointly, plus $1,400 for each qualifying dependent, including adult dependents.

Under the terms, individuals could receive up to $1,400 through the third stimulus checks. Couples who file jointly could get up to $2,800. Additionally, eligible dependents could also receive $1,400. To qualify, you had to be either a U.S. citizen or resident alien in 2021.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment (half the full amount). A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 (again, half the full amount).

To claim AOTC, you must file a federal tax return, complete the Form 8863 and attach the completed form to your Form 1040 or Form 1040A. Use the information on the Form 1098-T Tuition Statement, received from the educational institution the student attended.

What is the new tax credit Biden?

In his latest budget proposal, President Biden proposes enhancing the Child Tax Credit (CTC) based on the temporary credit that was in effect for 2021 as part of the American Rescue Plan Act. The temporary enhancement was an enormous success, cutting child poverty nearly in half.

A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund.

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

The ERTC is a refundable tax credit. It rewards businesses who kept employees during the COVID-19 pandemic, up to $26,000 per employee.

...

Tax Year 2023.

| Children or Relatives Claimed | Filing as Single, Head of Household, or Widowed | Filing as Married Filing Jointly |

|---|---|---|

| One | $46,560 | $53,120 |

| Two | $52,918 | $59,478 |

Below are the requirements to receive the Earned Income Tax Credit in the United States: Have worked and earned income less than $59,187. Have investment income less than $10,300 in tax year 2022. Have a valid Social Security number by the due date of your 2021 return.

The IRS previously forecast that refund checks were likely to be lower in 2023 due to the expiration of pandemic-era federal payment programs, including stimulus checks and child-related tax and credit programs.

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2022, largely due to the end of pandemic-related tax credits and deductions.

To get this payment, low-income individuals must file a simple 2007 federal income tax return showing at least $3,000 in qualifying income. If the IRS does not receive this tax return, no economic stimulus payment can be made. Once the tax return has been filed, the Internal Revenue Service does the rest.

Families with children between 6 and 17 years old will get $3,000. As for extending the tax credit into 2022, President Joe Biden wants the child tax credit to continue into 2022. It was part of the president's Build Back Better plan.

What is the $4200 tax credit?

FSA 2.0 would replace the current child tax credit of $2,000 with a child allowance of up to $4,200 per child under age 6 and $3,000 per child ages 6 to 17. Although the child allowance would not be fully refundable, like the 2021 CTC, it would phase in more quickly than the current CTC.

The payments were $1,400 per qualifying adult ($2,800 for married taxpayers filing a joint return) and $1,400 per dependent. For the third round of stimulus payments, taxpayers could get payments for dependents of all ages, including children over the age of 17, college students, and adults with disabilities.

If you received a $2,800 stimulus check, that likely means you have two qualified individuals. A married couple filing jointly, earning less than $150,000, should get $2,800 total.

However, even if you and your partner do not use a shared bank account, your combined stimulus check entitlement will have been sent to a single account. Whichever bank account is listed on your most recent tax returns should have received the payment, which would have been for $2,800 rather than $1,400.

...

Stimulus Check 2023.

| Name | IRS Stimulus Payment |

|---|---|

| Year | 2023 |

| Payment Type | Economic Impact payment |

| Website | https://www.irs.gov/ |

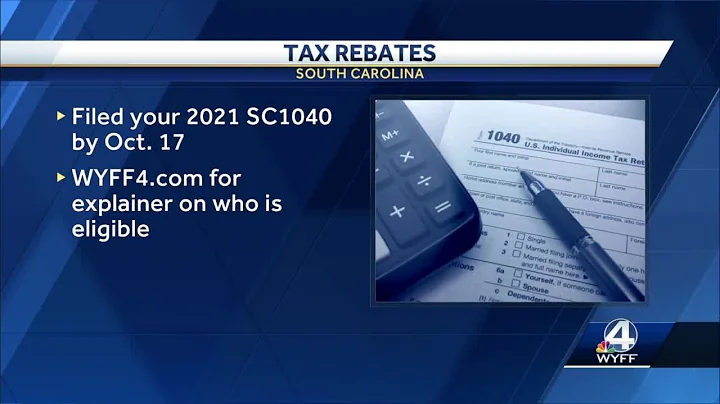

| States | California, Colorado, Idaho, Illinois, New Mexico, Pennsylvania, and South Carolina |

These refunds total around $14.8 billion, and the average amount eligible individuals will receive is $1,232. Here's why the IRS is distributing this money -- along with some details about who may be eligible for a payment in their bank account.

Who qualifies for an inflation relief payment? Single taxpayers making less than $250,000 a year. Heads of household making less than $500,000 a year. Couples who file jointly making $500,000 or less.

Individual filers who make between $75,000 and $125,000 a year -- and couples who earn between $150,000 and $250,000 -- were to receive $250 per taxpayer, plus another $250 if they have any dependents. A family with children could therefore receive a total of $750.

SSI and veterans will get this payment in the same way they got their first stimulus check.

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.

How do I get the full 2500 American Opportunity credit?

Anyone who falls within the income guidelines and is paying $4,000 or more in educational expenses per year will be eligible for the full $2,500. If you have less than $4,000 in qualifying educational expenses your credit will be less than this.

The child tax credit (CTC)

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,500 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

The American Opportunity Tax Credit (AOTC) is a tax credit for qualified education expenses associated with the first four years of a student's postsecondary education. The maximum annual credit is $2,500 per eligible student.

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2022 as a working family or individual earning up to $30,000 per year.

Overview. The Young Child Tax Credit (YCTC) provides up to $1,083 per eligible tax return. California families qualify with earned income of $30,000 or less.

The maximum credit is $1,400 per person, including all qualifying dependents claimed on a tax return. Typically, this means a single person with no dependents will have a maximum credit of $1,400, while married taxpayers who file a joint return that claims two qualifying dependents will have a maximum credit of $5,600.

The IRS says if you welcomed a new family member in 2021, you could be eligible for an extra $5,000 in your refund. This is for people who had a baby, adopted a child, or became a legal guardian. But you must meet these criteria:You didn't receive the advanced Child Tax Credit payments for that child in 2021.

- Select the right filing status.

- Don't overlook dependent care expenses.

- Itemize deductions when possible.

- Contribute to a traditional IRA.

- Max out contributions to a health savings account.

- Claim a credit for energy-efficient home improvements.

- Consult with a new accountant.

Most people with no issues on their tax return should receive their refund within 21 days of filing electronically if they choose direct deposit.

The checks worth $1,657 are only for Social Security recipients, not the general public.

Who qualifies for the $1000 check?

Your federal adjusted gross income (through employee pay) for 2020 tax is less than $150,000 if married filing jointly or if you're a qualifying widow or widower; $112,500 if filing as head of household; or $75,000 if single or married filing separately; and. During 2020, no one claimed you as a dependent.

We're sending out refunds worth over a thousand dollars to help families pay for everything from groceries to gas,” said Governor Newsom. Payments will range from $400 to $1,050 for couples filing jointly and $200 to $700 for all other individuals depending on their income and whether they claimed a dependent.

- Try itemizing your deductions.

- Double check your filing status.

- Make a retirement contribution.

- Claim tax credits.

- Contribute to your health savings account.

- Work with a tax professional.

Disabled Access Credit: This employer incentive helps small businesses cover the cost of making their businesses accessible to persons with disabilities. The maximum amount of the credit is $5,000.

How much is the 2022 child tax credit? For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers).

The tax year 2023 maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers who have three or more qualifying children, up from $6,935 for tax year 2022. The revenue procedure contains a table providing maximum EITC amount for other categories, income thresholds and phase-outs.

| State | Number of EITC Claims | Average EITC Amount |

|---|---|---|

| CALIFORNIA | 3.3 M | $1,857 |

| COLORADO | 430 K | $1,796 |

| CONNECTICUT | 270 K | $1,847 |

| DELAWARE | 91 K | $2,014 |

Basic Qualifying Rules

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2022. Have a valid Social Security number by the due date of your 2022 return (including extensions)

The American Rescue Plan, signed into law on March 11, 2021, expanded the Child Tax Credit for 2021 to get more help to more families. It has gone from $2,000 per child in 2020 to $3,600 for each child under age 6. For each child ages 6 to 16, it's increased from $2,000 to $3,000.

The income requirements for the recovery rebate tax credit are the same as for the stimulus payments. So if a stimulus check missed you or you received a partial payment, you may be eligible for additional cash if you file a federal tax return and claim the credit.

What is the $2,000 dollar federal tax credit?

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,500 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

How much is the 2022 child tax credit? For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers).

...

Tax Year 2022 (Current Tax Year)

| Children or Relatives Claimed | Filing as Single, Head of Household, or Widowed | Filing as Married Filing Jointly |

|---|---|---|

| Zero | $16,480 | $22,610 |

Single taxpayers earning less than $100,000 and couples making less than $200,000 combined will get their $300 checks. Single taxpayers earning more than $100,000 will only get $100 checks. Residents who lived for at least nine months in Hawaii qualify for the direct payment.

The Internal Revenue Service stated late in 2022 that many people can still receive stimulus payments in 2023, or perhaps at least a rebate on their tax returns from previous years. This includes about 25 million Californians who could qualify.

Generally, you are eligible to claim the Recovery Rebate Credit if: You were a U.S. citizen or U.S. resident alien in 2021. You are not a dependent of another taxpayer for tax year 2021.

Child tax credit (CTC)

In 2022, the CTC is worth up to $2,000 per qualifying child for filers earning less than $200,000 annually or $400,000 for those filing jointly.

But, the good news is, the IRS has made clear that many parents will still be eligible for payments of up to $2,000 for the 2022 tax year. These $2,000 payments are an option for families because a Child Tax Credit existed before the COVID-19 relief bills.

There may be other reasons that a taxpayer's refund may be lower this year, such as a change in the number of dependents being claimed, change in filing status, change in employment, increase in self-employment income, or other factors that occur during 2022 that did not occur in earlier years.