What is the best money rule?

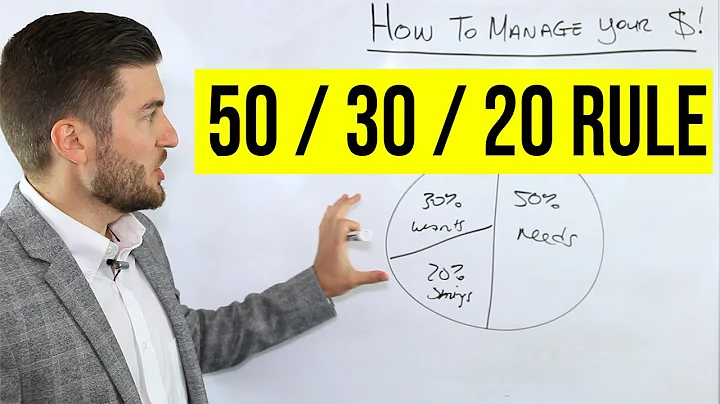

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

Warren Buffett once said, “The first rule of an investment is don't lose [money]. And the second rule of an investment is don't forget the first rule. And that's all the rules there are.”

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

Is the 50/30/20 budget rule right for you? The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough.

Personal finance doesn't have to be complicated. In fact, there is a “golden rule” that everyone should follow, and simply by adhering to it, you'll be on a path to financial freedom. The Golden Rule is this: Don't spend more than you earn, and focus on what you can KEEP!

THE 4-3-2-1 APPROACH

One simple rule of thumb I tend to adopt is going by the 4-3-2-1 ratios to budgeting. This ratio allocates 40% of your income towards expenses, 30% towards housing, 20% towards savings and investments and 10% towards insurance.

The Rule of 72 is a calculation that estimates the number of years it takes to double your money at a specified rate of return. If, for example, your account earns 4 percent, divide 72 by 4 to get the number of years it will take for your money to double.

The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

Introducing the 70-20-10 rule, a realistic money budgeting rule that can make it easier to save during the cost of living crisis. Read now, save better. Introducing the 70-20-10 rule, an alternative to the old (and maybe outdated) 50-30-20 budgeting rule.

70/15/15 Budget

With this budget rule, you'll spend 70% on needs, 15% on wants, and 15% on savings.

Is 4000 a good savings?

Are you approaching 30? How much money do you have saved? According to CNN Money, someone between the ages of 25 and 30, who makes around $40,000 a year, should have at least $4,000 saved.

Personal finance expert Dave Ramsey says if you're going through a tough financial period, you should budget for the “Four Walls” first above anything else. In a series of tweets, Ramsey suggested budgeting for food, utilities, shelter and transportation — in that specific order.

Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

- Invest.

- Take advantage of compound interest.

- Create a plan and follow it.

- Start a business.

- Cut spending.

- Try taxing yourself.

- Consider additional education.

- Take calculated risks.

If you find yourself in this situation, consider the “Rule of Three:” When you have an unexpected windfall, put 1/3 of the windfall towards paying down debt, 1/3 towards long-term saving and investing, and the remaining 1/3 towards something rewarding or fun.

When To Sell And Take A Loss. According to IBD founder William O'Neil's rule in "How to Make Money in Stocks," you should sell a stock when you are down 7% or 8% from your purchase price, no exceptions. Having a rule in place ahead of time can help prevent an emotional decision to hang on too long.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

The 4% rule is a popular retirement withdrawal strategy that suggests retirees can safely withdraw the amount equal to 4% of their savings during the year they retire and then adjust for inflation each subsequent year for 30 years.

The calculation begins with the number 100. Subtracting your age from 100 provides an immediate snapshot of what percentage of your retirement assets should be in the market (at risk) and what percentage of your retirement assets should be in safe money (no risk) alternatives.

Rule of 69 is a general rule to estimate the time that is required to make the investment to be doubled, keeping the interest rate as a continuous compounding interest rate, i.e., the interest rate is compounding every moment.

How can I double $5000 dollars?

- Stock Market.

- P2P Lending.

- High-Yield Accounts.

- Start a Small Business.

- Invest in Yourself.

Try Flipping Things

Another way to double your $2,000 in 24 hours is by flipping items. This method involves buying items at a lower price and selling them for a profit. You can start by looking for items that are in high demand or have a high resale value. One popular option is to start a retail arbitrage business.

No, there is not a savings account that pays 7% APY right now. The Landmark Credit Union Premium Checking Account pays 7.50% APY, but only on balances up to $500. If you keep more than $500 in your account, you're better off opening a high-yield savings account that pays a slightly lower rate on your total balance.

No financial institutions currently offer 7% interest savings accounts. But some smaller banks and regional credit unions are currently paying more than 6.00% APY on savings accounts and up to 9.00% APY on checking accounts, though these accounts have restrictions and requirements.

When your savings reaches $100,000, that's a milestone worth marking. In a world where 57% of Americans can't cover an unexpected $1,000 expense, having a six-figure savings account is commendable.