What is the two biggest sources of tax revenue?

Federal Budget. What are the sources of revenue for the federal government? About 50 percent of federal revenue comes from individual income taxes, 7 percent from corporate income taxes, and another 36 percent from payroll taxes that fund social insurance programs (figure 1). The rest comes from a mix of sources.

Most tax revenue is from income tax, NICs & VAT

The taxes in each category can be seen in the table below. As shown by the chart, around two-thirds of tax revenue comes from just three taxes: income tax, National Insurance contributions (NICs) and value added tax (VAT).

A portion of taxes may be used to service past debts. Governments also use taxes to fund welfare and public services. These services can include education systems, pensions for the elderly, unemployment benefits, and public transportation.

Taxation is, by and large, the most important source of government revenue in nearly all countries.

The only real way for government to get more money is through more people paying income tax, and more companies paying company tax.

Tax revenue is defined as the revenues collected from taxes on income and profits, social security contributions, taxes levied on goods and services, payroll taxes, taxes on the ownership and transfer of property, and other taxes.

The 5 major sources of revenue for the Government are Goods and Services Tax (GST), Income tax, corporation tax, non-tax revenues, union excise duties .

In 2020-21, 28.5% of the revenue came from GST followed by corporate tax and personal income tax, 28.1% and 28.3% respectively.

The Indian government's main source of income is from Goods and Services Tax (GST) and income tax. Both forms constitute nearly 90% of the government's total tax collection. In 2021-22, GST contributed over 57% to the total tax collection.

There are four primary types of revenue streams: transactional, project, service, and recurring.

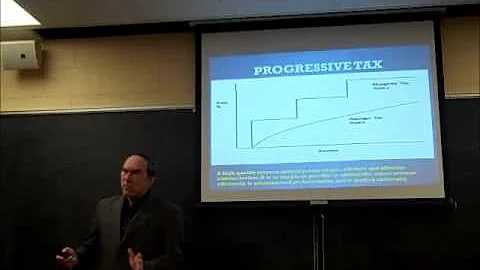

What are the two types of tax revenue?

Taxes collected from both direct tax and indirect tax are the government's tax revenue. It includes collections from income tax, corporation tax, customs, wealth tax, tax on land revenue, etc. Direct tax is the tax that is paid directly to the government by the person or company on whom it is levied.

Revenue can be divided into operating revenue—sales from a company's core business—and non-operating revenue which is derived from secondary sources. As these non-operating revenue sources are often unpredictable or nonrecurring, they can be referred to as one-time events or gains.

Income tax is the government's main source of income and is levied in terms of the Income Tax Act, 1962 [the Act].

- Asset sale. The most widely understood Revenue Stream derives from selling ownership rights to a physical product. ...

- Usage fee. ...

- Subscription fees. ...

- Lending/Renting/Leasing. ...

- Licensing. ...

- Brokerage fees. ...

- Advertising.

Government also gets money from sin taxes, loans, donations and investments. Local government gets most of its income from selling electricity and water and from a special tax on property called `property rates'. They also get grants from national Treasury for infrastructure and for the equitable share.

The 6 major sources of tax revenue are Income tax, corporate tax, Goods and Services Tax (GST), Customs duties, Union Excise duties, Wealth tax and gift tax.