Income Tax Return (ITR) is a form that must be submitted to the Income Tax Department of India. It contains information about the individual's income and the taxes that must be paid on it throughout the year. The information filed in ITR should be for a specific fiscal year, beginning on April 1st and ending on March 31st of the following year.

Table of Contents

- How to Download Income Tax Return (ITR) Online?

- How to Download XML files for ITR?

- How to Download the ITR Computation Sheet?

- How to Download ITR-V?

How to Download Income Tax Return (ITR) Online?

Online filing of income tax returns has become very simple and convenient in recent years, allowing individuals to do it themselves rather than relying on a tax practitioner. Filing an income tax return is a requirement for everyone.

However, no filing is required for individuals under the age of 60 whose gross total income before deductions are less than Rs. 2.10 Lakhs. This limit is Rs. 3 lakh for resident senior citizens (aged 60 to 80 years) and Rs. 10 Lakhs for resident super senior citizens (aged above 80).

Follow the steps listed below to download income tax return:

- Step 1: Go to the official income tax filing portal. Click on the ‘Register’ or ‘Login’ button on the income tax portal.

- Step 2: If you are a new user, click ‘Register.’ (To register, choose a user type, enter the required information, and validate the registration.) If you are an existing user, click the ‘Login’ button.

- Step 3: After you've logged in, go to ‘My Account’ and select ‘Download Pre-filled XML.’ Choose the Assessment Year for which a return is required. Select the ITR Form Number for which the Excel utility was downloaded.

- Step 4: Select the applicable ITR Form based on the nature of income mentioned in the description box, and download it in Microsoft Excel format.

- Step 5: Save the XML file to your computer.

- Step 6: The Excel and XML utilities will be saved in the PC's downloads folder. By clicking on ‘Import from XML,’ you can import data from the pre-filled downloaded XML file into the Excel utility.

How to Download XML files for ITR?

- Check the auto-filled information and fill in the blanks in the excel utility. Once all of the required information has been entered, click the "calculate tax" button. If you need to pay taxes, go to the “Taxes Paid and Verification” tab and select “e-pay Tax.”

- You will be taken to the NSDL website. Choose the appropriate options and pay the taxes. The challan will be produced.

- Enter the challan details in the excel utility under the "TDS" tab> "Sr No 21 IT – Details of Advance Tax and Self-Assessment Tax Payments."

- In each sheet, click the “Validate” button, followed by “Generate XML file.”

- A summary tab with the option to "save XML" will be generated.

Filling out the XML File

- After saving the XML file, log in to the portal and select the “Income tax return” option under the “e-file” tab. Choose ‘Upload XML’ for the assessment year, ITR form number, filing type, and submission mode. Select the option to e-verify the return as well. Upload the XML file and then press the Submit button.

- Verify the return using e-mail.

- Verify the return by using an Aadhar OTP or a Net Banking OTP. If the user does not wish to e-verify the return, the ITR must be submitted to CPC Bangalore within 120 days.

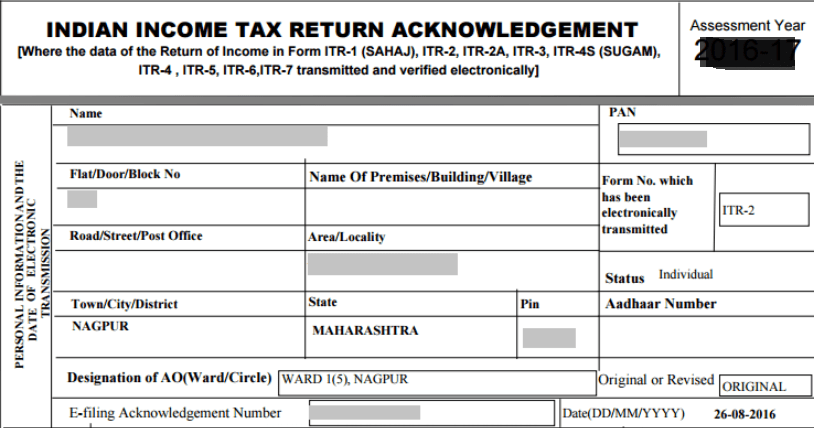

- When the return is successfully uploaded, an income tax acknowledgment will be generated.

The Income Tax Department has prescribed seven types of ITR forms: ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7, and the form's applicability is determined by the nature and amount of income as well as the type of taxpayer.

| ITR Form type | Applicability |

|---|---|

| The interest rate is higher. | The interest rate is lower. |

| ITR- 1 | To be filed by residents with a total income of up to 50 lacs from the following sources:

|

| ITR-2 | Individuals and HUFs who are not eligible to file form ITR-1 and do not have income from profits and gains from business or profession must file this form. |

| ITR-3 | Individuals and HUFs with profits and gains from a business or profession must file this form. |

| ITR-4 | To be filed by resident individuals, HUFs, and firms (other than LLP) with total income up to 50 lacs and income from business or profession computed under section 44AD, 44ADA, or 44AE. |

| ITR-5 | To be filed by persons other than

|

| ITR-6 | This is for companies that do not claim an exemption under Section 11 |

| ITR-7 | To be filed by persons and companies who are required to furnish returns under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only |

How to Download the ITR Computation Sheet?

The assessee can now check his return with the computation sheet to see the variance and respond to the department accordingly. Where demand is raised manually outside the system, the assessee must request a resend of the intimation through the portal or contact the jurisdictional Assessing Officer.

Given below is the detailed procedure

- Step 1: Visit the official website for income tax filing.

- Step 2: Log in to your account by entering PAN details and password.

- Step 3: Select e-File ‘Response to Outstanding Tax Demand' after logging in.

- Step 4: When you click the button Response to Outstanding Tax Demand, a window will open that shows any outstanding tax demands.

- Step 5: If there is a tax demand, the assessee can download the details in PDF format by clicking on the download button next to the demand amount.

How to Download ITR-V?

ITR-V is the acronym for Income Tax Return Verification, and it is generated by the IT department for taxpayers to verify the legitimacy of their e-filing.

It only applies to those who file without using a digital signature. It is now simpler than ever to obtain your ITR-V from the convenience of your own home or office.

The process to download ITR-V is summarised in the steps below:

- Step 1: Log in to the Income Tax India website.

- Step 2: To view e-filed tax returns, select the ‘View Returns/ Forms' option.

- Step 3: To download your ITR-V, click on the acknowledgment number. You could also opt to e-verify your tax return.

To e-verify, go to the ‘Click here to view your returns pending for verification’ option.

- Step 4: To start ITR acknowledgment download, select ‘ITR-V/Acknowledgement.'

- Step 5: Once the document has been downloaded, enter the password to open it. The password is your PAN number in lower case letters, followed by your date of birth.

Example:

- PAN: BPKAP113F

- DOB: 11/03/1987

- Password: BPKAP113F11031987

- Step 6: Print, sign, and return this document to CPC Bangalore within 120 days of the e-filing date.

Requirements for ITR-V

- A taxpayer should have filed an ITR for a certain fiscal year and received an acknowledgment in ITR-V.

- The ITR-V would include an acknowledgment number, which is required for the e-verify service.

- The ITR should be submitted by a taxpayer who is not required to sign the ITR with a DSC (Digital Signature Certificate)

- An authorized signatory or representative assessee should not file the ITR.

Conclusion

Every Indian citizen whose gross total income exceeds the taxable limit in a fiscal year is required to file an income tax return, as is common knowledge (ITR). According to tax experts, filing income tax returns is required where an individual's gross total income exceeds Rs. 2,50,000. The importance of filing the ITR on time cannot be overstated, given the consequences of failing to do so. Filling out ITR also has several long-term benefits, so it is recommended for all wage earners to do so.